Opportunity and Momentum for ASCs

The momentum for the migration of total joint surgeries from the hospital inpatient setting to the hospital outpatient setting and the ASC setting has been favorably impacted by technological advances, surgical techniques, increased effectiveness in postoperative care, and—the single most important factor—the demand for the US to decrease the total cost of healthcare.

Consumers and employer groups are holding commercial payors (CPs) accountable, while employer groups are demanding that CPs sustain and reduce both premiums and the total spend on healthcare. This is increasingly prevalent with large employer groups that are self-funded and, where pricing sensitivity to rising healthcare cost is a top priority for major employers as indicated by the recent announcements of Amazon, JP Morgan and Berkshire Hathaway.

As baby boomers are reaching retirement, and the general population is living longer with more active lifestyles, the projected number of total knee arthroplasty (TKA) and total hip arthroplasty (THA) procedures for the Medicare and commercial patient population is expected to increase. Removing total joint procedures from the inpatient-only list enables cost reduction that results from performing these cases in the outpatient setting. In 2018, Medicare removed TKA procedure CPT code 27447 from the inpatient-only list and also considered the procedure for approval on the ASC list. The THA procedure CPT code 27130 was also proposed for removal from the inpatient-only list, but this change was not approved. It is only a matter of time before THA is removed from the inpatient-only list and both TKA and THA are approved for the ASC setting. Many CPs have proprietary approved code lists that include total joints for ASCs. When CMS approves a code for the hospital outpatient department (HOPD) setting, CPs will have support to approve the codes for the ASC setting. Adding TKA to the HOPD list is expected to increase the ASCs’ ability to negotiate with CPs.

Implications on Reimbursement

Medicare

Although TKA is not yet approved in the ASC setting, it is interesting to consider the variance in reimbursement for TKA when comparing the 2018 MS-DRG 470 rate of $12,380 to the HOPD rate for TKA CPT code 27447 of $10,123.1 The HOPD rate represents an 18% reduction. CPT code 27446, which is uni-compartmental knee arthroplasty (Uni-Knee), is approved for the ASC setting. In the HOPD, the Uni-Knee, CPT code 27446, and TKA, CPT code 27447, yield the same reimbursement rate of $10,123, while in the ASC setting, the reimbursement rate for CPT code 27446 is $7,374, representing a 28% differential when compared to the HOPD rate. Both CPT codes 27446 and 27447 are classified as device-intensive codes by CMS which provides reimbursement attributed to the device or implant cost and has a favorable impact on closing the gap on reimbursement rates. When a code is approved for the HOPD and the ASC, the cost attributed to the device is based on the HOPD cost information. Is it safe to assume that if TKA were added to the ASC list, the reimbursement rate could be similar to CPT code 27446, at $7,374?

Consider the following example. In 2018, the device allocation for TKA in the HOPD setting is based on the device offset percentage of 41% which is used to calculate the amount of reimbursement that is intended to cover the cost of the device or implant, is calculated at $4,150.40.2 For the Uni-Knee, the device offset percentage is 47.4%, and the device portion of reimbursement represents $4,798.26. In the ASC setting, the device offset percentage published for the Uni-Knee is 49.44%, with a published device offset amount to cover the cost of the device or implant is $4,811.02.3 The difference in the ASC- and HOPD-allowed amounts and the amount attributed to the device or implant cost is fairly equitable for the 27446. Applying the same logic for the CPT code 27447, is it safe to assume that the reimbursement amount allocated for the implant, if TKA were approved for ASCs, will be similar to the $4,150.50 specified for HOPDs?

The ability to migrate Medicare TKA and other total joint surgeries to the outpatient setting is highly dependent on the cost and patient selection. The cost of the implants can have a significant impact since they are not paid separately in the Outpatient Prospective Payment System (OPPS) used by CMS. Other key factors that impact migration include payor mix, capital expenditures, ASA levels, and the total cost of care. If performing cases in the ASC setting results in a loss for a high-volume payor, the reimbursement from CPs must be greater to offset the losses from Medicare or other nonnegotiable payors. ASCs must consider the cost of capital, in addition to direct and indirect operating costs.

Commercial Payors

With the approval of CPT codes and rate setting by CMS of TKA and other total joint codes in the HOPD and/or ASC setting, CPs frequently look to CMS as a baseline for setting reimbursement rates. When comparing CPs to CMS, there may be opportunities to access additional reimbursement for the implant or to negotiate the cost of the implant into the total reimbursement rate for the case. This is highly dependent upon the CP’s methodology and flexibility with the reimbursement logic used to compensate ASCs. Total joint surgeries will typically be billed without multiple procedures, and only with implants. Therefore, total joints are a bit more simplistic from the standpoint of rate negotiations.

CPs are being pressured by employer groups to reduce or sustain premiums. Most major payors have self-funded customers who take on the full risk of the cost of healthcare for their employees. Employer groups are holding CPs accountable for pricing for surgical services. If a total joint procedure, such as TKA, is reimbursed at $40,000 in the hospital setting, that is ultimately a cost to the employer group. Alternatively, if an ASC can demonstrate the ability to migrate 100 cases per year at a reimbursement rate of $25,000, these savings substantially reduce the cost to the employer group, payor, and ultimately the patient, at a rate of $1.5 million on only 100 cases per year. CPs may entertain alternative payment methods, including incentives for physicians to move cases, which can be very advantageous to the ASC and surgeon. An ASC’s ability to demonstrate this level of value to the CP will afford it material opportunity and success with negotiating more meaningful rates and will support capital acquisition cost and the migration of cases from the hospital for patients who meet the clinical criteria for the ASC setting. This opportunity for ASCs poses a material risk to hospitals.

Considerations for Hospitals

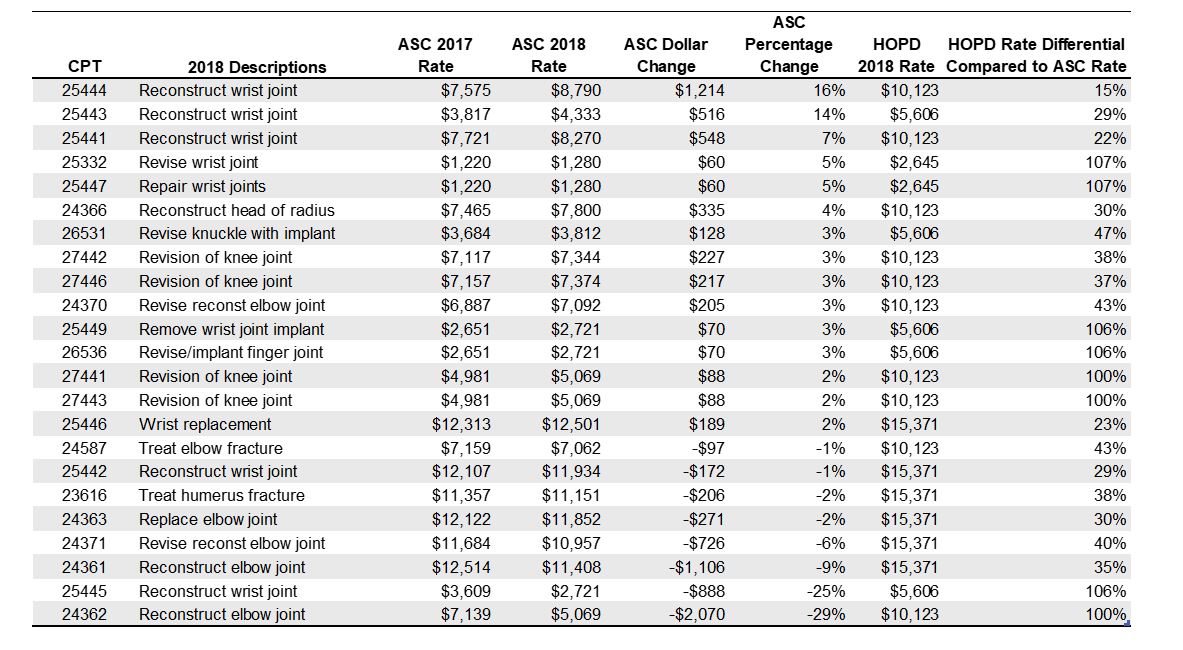

As hospitals are faced with the increased migration of total joint surgery, they must be prepared for financial losses from the Medicare reductions when these procedures are performed and classified as outpatient instead of inpatient. When CPs contract with ASCs at reimbursement rates that support and enable migration, this represents a meaningful reduction in cost compared to the hospital. When reviewing CMS’s ASC-approved total joint procedures in 2018 presented in table 1 and the rate changes in 2018 as compared to 2017, with comparison to HOPD rates, the rate differential is closing and, in many instances, providing more momentum for migration. As indicated with CPT code 25444, the rates are at a 15% differential.

Table 1: Joint Procedures Approved in the ASC Setting

The accountability of payors from employers and consumers to lower costs puts pressure on hospitals to demonstrate their commitment to reducing the total cost of care. Reimbursement rates from CPs for total joints are expected to decline in the hospital setting as more volume migrates over to HOPDs and ultimately the ASC setting.

Conclusions

ASCs continue to be part of the solution in healthcare. Enabling total joint surgery to be performed in ASCs increases opportunities for reducing the total cost of care. The expansion of the approved total joint procedure list by CPs, access to favorable clinical outcomes, and patient satisfaction data coupled with cost data are expected to strengthen the ability of ASCs to demonstrate value to payor and employer groups, which validates rate negotiations. It will only be a matter of time before TKA and THA are approved by CMS for the ASC setting, which will encourage enhanced ASC payor relationships. Approval of total joints and closing the gap on reimbursement rates clearly increases the financial risk to hospitals, while enhancing the motivation of payors to align with ASCs. The level of success that an ASC can expect to realize when negotiating with CPs for total joints is directly correlated with the commitment to collect and present the payor with meaningful data. Demonstrating value and savings opportunities, combined with favorable outcomes and a positive relationship with the payor, are critical to success.

1 Figures may not be exact due to rounding.

Sources to the rates are: Acute Inpatient, Hospital Outpatient, and ASC Payment, 2018, from: https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/AcuteInpatientPPS/index.html

https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/. HospitalOutpatientPPS/index.html.

https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/ASCPayment/index.html.

2 https://www.cms.gov/apps/aha/license.asp?file=/Medicare/Medicare-Fee-for-Service-Payment/HospitalOutpatientPPS/Downloads/CMS-1678-CN-2018-OPPS-HCPCS-Offset-File.zip.

3 https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/ASCPayment/ASC-Policy-Files.html.