By all accounts, GI as a specialty — and especially single-specialty GI ASCs — will be hit the hardest by CMS’s restructuring of the ASC payment system. But despite a 4.3 percent average cut for GI procedures, the situation is not as dire as it may seem at first glance, nor is it impossible to increase profitability in the new market.

“We performed a site-by-site analysis to determine the impact at each facility,” says John Poisson, the executive vice president at Physicians Endoscopy, which works exclusively with GI-focused facilities. “You really need to look at all your payers and not just Medicare in determining what will be the real impact on your center.”

And according to Physicians Endoscopy’s calculations, “not taking into account payment increases from non-governmental payers over the next couple years, we’re seeing an impact of only about 1 percent per year average reimbursement per procedure,” says Mr. Poisson. For a center that does 11,000 procedures annually (34 percent of them being Medicare and commercial Medicare patients), the bottom-line impact is only $60,000 total (see “Breaking Down GI Cases”).

“That’s only three endoscopes in the grand scheme of things,” he notes.

Based on Physicians Endoscopy’s analysis, Mr. Poisson lists four key steps you can take to compensate for the Medicare cuts’ estimated hit, and to help increase the profitability of GI in your ASC.

1. Stay on top of third-party payors.

Looking first for ways to enhance your reimbursement is a far more efficient route for boosting the bottom line than trimming “fat” from operations or supply costs, for example, could be. As a result, examining your contract with third-party insurers is a good place to start.

“In terms of managed care contracting, we haven’t seen any negative from Medicare interpretation from the private payors, so that has been encouraging to date,” says Rodney H. Lunn, the CEO of Surgical Health Group in Brentwood, Tenn. “If you’re concerned about [private payors’ rates] going down, I think looking at contracts for three years is a wise decision. I think especially when you’re looking at cuts from Medicare, it probably would be smart to because I think ultimately there will be cost pressure or payment pressure.”

He notes that it’s best to deal with contracts as they expire, however.

“We haven’t had too much success between contract periods,” says Mr. Lunn.

Mr. Poisson recommends renegotiating with non-governmental payers every 18 to 24 months.

“The vast majority will provide rate increases,” he says. “It may be 3 to 5 percent, though in some cases up to 10 percent, but any rate increases will help offset increases in expenses and decreases in governmental reimbursement.”

Any increase will help — just $15 more per procedure equates to $105,000 pure profit in a center that performs 7,000 procedures annually — but there’s absolutely no reason to accept a decrease.

“We’re negotiating contracts and we are emphatic about not allowing Medicare cuts to be transferred over to third parties,” says Bergein “Gene” Overholt, MD, FACP, MACG, of Gastrointestinal Associates in Knoxville, Tenn., and a past-president of the American Society for Gastrointestinal Endoscopy and the American Society of Outpatient Surgeons. “They are trying and they are testing the water, and we are just flat rejecting that approach. We won’t discuss that. We’ll walk.

2. Bring in the cases.

“If you can increase your volume, that will go a long way to offset any bottom-line discomfort,” says Mr. Lunn. There are several areas to mine in order to ensure you’re getting a maximum number of cases referred to your center.

“Not everybody’s compliant with getting their colonoscopies when they reach the appropriate age. As a result, I think there are a whole lot of people out there who need and could be having procedures done, but who aren’t. You need to make sure your physicians are doing everything they can to recruit new physicians or bring more volume into the center. In-servicing your primary care physicians to make them aware and community awareness programs are both important.”

For example, he says, “a lot of women go almost exclusively to their GYNs. Are these physicians fully aware that maybe their patients need to have

screening colonoscopy done? That might be an area that is neglected in terms of education from a colon cancer standpoint.”

The schedulers in the physicians’ practices are possibly the biggest factor in bringing in cases to your ASC, so it’s important to network with them and make their lives as easy as possible, especially if the physicians are utilizers but not owners.

“Provide schedulers with a script that lists what to say and where to say it. The schedulers truly want to do a good job, but it’s very easy to fall back into scheduling patients at the hospital because it’s less work and less challenging,” says Mr. Poisson. “We encourage the physicians to monitor the scheduler’s interactions with patients frequently in the first few months — you need to trust they are doing what they’ve been asked to do, however, verification by management is critical.”

Further, it’s key that you communicate with schedulers (and their physicians) the importance of early notice of vacations or other planned time off that might leave blocks open in the future. Physicians Endoscopy has found that the success rate of filling a block with at least 30 days’ advance notice is greater than 85 percent in its partnered centers; it’s less than 15 percent for less than 48 hours’ heads up. Estimating average reimbursement of $500 per case, leaving one room open for just one day costs an ASC $7,500; one open block weekly for a year costs $390,000 in revenue, says Mr. Poisson. He advises using a three-step open-slot process that highly involves the schedulers at the physicians’ offices to help fill every patient block within each daily physician block.

• Patients evaluated in office are scheduled normally for a procedure in the ASC and asked if they wish to be placed on a priority list if availability in the physician’s schedule arises within the next three weeks.

• Patients who are evaluated by phone are also both scheduled normally and asked about priority list placement.

• If a patient slot opens up in any physician block at the ASC within four business days, patients on the priority list are contacted until one fills the gap.

Adding just one incremental case to each room daily works out to more than 750 annually for the typical three-room ASC — about $375,000 in revenue annually. This is a way the schedulers can contribute to one of the biggest contributors to profitability — utilization — and much can be done on the ASC side as well.

3. Assess room utilization.

This is a very important decision the board needs to make regarding what it will and won’t require of utilizing physicians and physician-owners alike.

“[To keep up with the Medicare cuts], we are

planning to enhance business as usual,” says Dr. Overholt. “That means being sure that our volumes are high, scheduling properly to fill block times and being sure people start on time. We don’t tolerate tardiness and we want people on task.”

The difficulty is that, in GI, physicians by and large want morning blocks — but you’re paying for the room, whether it’s full or sits empty, all day.

“We tend to see very high utilization rates in rooms in the morning, typically greater than 95 percent,” says Mr. Poisson. “But in the afternoon it often plummets to the mid-70s. Yes, it’s hard to ask a patient on NPO to come in at 3:30; however, it’s very important to examine whether you’re running rooms at lower utilization for physicians’ convenience or because you don’t have the cases.”

When approaching utilization issues in your center, honestly determine whether you are already high-utilization or have room for improvement, based on these criteria:

• performing 3,000 to 3,500 procedures a year per room;

• performing 12 to 16 procedures per room per day between 7:30 a.m. and 3 p.m.;

• meeting a utilization rate of 95 percent in the morning; and

• meeting a utilization rate of 80 percent in the afternoon.

For those centers in which all rooms are being utilized to a large degree each day — in other words, the minority of centers — you’re not a victim of your own success.

“If you happen to be well-utilized, you have the ability to make the decision to not bring certain payors into the mix,” says Mr. Poisson. “Have physicians take the less-profitable cases to the hospital or another venue. For example, the Medicare codes for screening, which took the biggest hit, that’s the first thing I pull out of our fully utilized centers. If you know a particular patient is just a simple screening, and you have the option of filling that slot with a payor that’s more profitable, you should do that.”

The second kind of center, those with potential for greater utilization, are those running under the 90 or 95 percent mark, and that’s where most fall. The good news: You likely have opportunities for improvement.

“It’s just a matter of coming up with what works for your center, or even physician by physician,” says Mr. Poisson.

On the center level, one example of a fix is slightly overbooking the schedule.

“You can usually count on one or two patients either canceling or not showing, so knowing that, you can double-book and add one or two patients beyond the slots available,” he says. By doing so, “nine times out of 10, if you’ve got 15 patient slots for a given room that day, you end up with 15 actually showing up. When all 17 do show up, in my experience, it doesn’t cause a bump; staff and physicians step up to that challenge and meet it.”

Don’t be afraid to customize physicians’ blocks if they work at different speeds — especially if it means enhancing utilization.

“Most centers book each physician a 30-minute patient block, but there are just some physicians who are faster at the same level of quality,” says Mr. Poisson. “There’s nothing to say that, for certain faster physicians, you couldn’t book 20-minute blocks. The ability to add one procedure per room per day adds up to tremendous additional profits by the end of the year.”

You must ensure that relative staffing levels in admitting and recovery permit these moves, of course; “the No. 1 objective always has to be patient safety,” he says. “I’m a big believer that patient safety and quality medicine can be mutually inclusive with profitability.”

4. Undertake quality initiatives.

“High quality just improves the product of endoscopy,” says Dr. Overholt. “Not just how you perform it, but it also improves patient satisfaction scores and physician satisfaction scores.”

Further, when you track quality indicators, you can put the performance data to use as a bargaining chip with insurers.

“Some centers, with certain payors, have arrangements where, for example, on a quarterly basis, they will provide quality reporting to the insurer and get a reimbursement increase for meeting specific

targets,” says Mr. Poisson. “An extra 5 percent in reimbursement, that translates to a lot of dollars.”

Within your center, you can use quality tracking to detect inefficiencies and devise methods for improvement that will produce savings that go directly to the bottom line, says Sean Benson, the vice president of consulting and co-founder of Provation Medical, which makes procedure documentation software. As an example, he cites Central Bucks Specialists in Doylestown, Pa., was suffering from inconsistent room turnover that caused scheduling problems and resultant frustration on all sides.

“When we tried to get to the bottom of the problem we got myriad answers,” says Zvi Weinman, MBA, the administrator of Central Bucks, which performs 8,000 GI procedures annually. “The staff thought it was caused by the physicians, the physicians thought it was caused by the staff, and occasionally, everyone thought it was caused by the anesthesiologists.”

Mr. Weinman was able to have hard data in hand that allowed him to analyze the problem objectively by tracking quality indicators: arrival to patient in room; patient in room to time-out; time-out to scope-in; scope-in to scope-out; scope-out to recovery start; recovery start to discharge; and polypectomy rate. Two areas stood out.

• Time-out to scope-in time. Five of six practicing physicians, were averaging within minutes of one another; the sixth was averaging close to 20 minutes longer than the others per procedure. The discrepancy was due to his conscious sedation practice: “Rather than giving a big bolus up front, he was doing a little at a time, and onset of the anesthetic took markedly longer as a result,” says Mr. Benson. “When he was able to see the difference his conscious sedation practices were having on his procedure times, and that what his peers were doing wasn’t affecting outcomes adversely, he changed practice.”

• Scope-in time to scope-out time. Four of six doctors averaged within minutes of one another for scope time. One took markedly longer, and another was significantly shorter. It was not a matter of quality, but rather a matter of practice preference. For the physician who took longer, “they just scheduled his procedures for an extra 15 minutes each, and built it into the schedule,” says Mr. Benson. “That way, the staff could anticipate, and backups for his patients were eliminated.”

The faster physician opted to slow his scope withdrawal to ensure greater consistency and better adhere to identified GI best practices.

Some good news is that “GI is clearly out in front of every other specialty with regards to quality improvement,” says Mr. Benson. “There are a lot of things going on in the world of GI QI, thanks to the ASGE and ACG getting together to create a QI pilot study that captures 80 data points for each colonoscopy (download it: http://www.asge.org/WorkArea/downloadasset.aspx?id=3386 ). For day-to-day practice, this needs to be distilled down to a handful, but it’s helpful that efforts in this area are so thorough.”

Stick to basics

“The best ways to enhance profitability are by looking at fundamentals; there’s nothing really new here,” says Mr. Poisson. “It’s just a reminder that, to run a GI ASC, you really need to be an efficiency expert.”

Further, the four-year phase-in will help offset declining Medicare reimbursements, especially in GI.

“Reimbursement is clearly going down,” says Mr. Poisson. “But you can’t look at it in a vacuum; if you do, the situation is horrible. The average center’s cases are two-thirds non-governmental payors. If you integrate Medicare payments with the rest of your payer mix, the situation is not nearly as Draconian as has been broadcasted.”

Contact Stephanie Wasek at stephanie@eckersasc.com . Rob Kurtz (rob@beckersasc.com ) contributed to this report.

3 More Ways to Enhance Profits

• New lines of service. “For those centers that are underutilized, there is the ability to add pain or lumps and bumps or things like that,” says John Poisson, the executive vice president at Physicians Endoscopy. “If you have the capabilities, you can use procedure rooms for these.”

You might also look into adding ancillary services, says Bergein “Gene” Overholt, MD, FACP, MACG, of Gastrointestinal Associates in Knoxville, Tenn.

“We are investigating the possibility of implementing new revenue streams,”

he says. “Pathology is the big one, but there are also imaging centers and labs — a new [service line] is the possibility of adding a pharmacy dispensing

GI medications.”

• Cut repair costs. “Is there any way to cut your repair costs, which can add $4 or $5 to a procedure just on scope maintenance and repair?” asks Rodney Lunn, the CEO of Surgical Health Group. If you find that maintenance costs eat up a large portion of the budget for equipment that is fairly new, you should look at how staff are handling the instruments and determine whether they are employing proper handling and reprocessing techniques.

“Are scopes tested for leaks before they are submerged, for example,” says Mr. Lunn. “There are procedures that people can go through to determine whether you have a leak, so you can have it repaired before it damages the scope. A lot of people will buy used scopes and find that their maintenance costs are higher and you’re better off just buying newer equipment because your maintenance costs are down. You spend a little bit more on the front end but you’re able to save and have better material to work with.

• Examine supply costs. Dr. Overholt cites his facility’s membership with a GPO as a key factor in saving on supplies, but also notes that there are steps you can take within the facility to save.

“We are controlling supply costs, within reason,” says Dr. Overholt. “Standardization of items such as gowns, gloves, and masks, and those types of supplies where physician preference often differs but quality doesn’t, lets you control your costs more effectively. We make our physicians aware that supply costs are a critical element; we just point out that everybody’s little variations that they like, even though they like them and it would be nice to do for everybody, drives costs up. They get involved in this aspect, and peer pressure to standardize helps bring costs down.”

Breaking Down GI Payments

According to Physicians Endoscopy’s calculations, which don’t take into

account any cost-of-living increases that may later be built into payments, there’s only a $7 per-procedure average difference.

• 2007: $446 is the average per-procedure reimbursement across GI procedures

• 2008: $441

• 2009: $439

• 2010: $437

• 2011: $439

“That’s why case-costing is so important,” says John Poisson, the executive vice president at Physicians Endoscopy. “Say the center is doing 30 procedures a day, you’re down $170. If you’re able to schedule just one more patient in that day over your typical utilization, you’re up.

“The profit-drivers in ASCs are always volume and utilization, those are always the biggest bang for you buck. No. 2 is the payer rates, third tier is expenses. Get the right staff, don’t overstaff. Then you can focus on things like extending scope life, better purchasing power with a GPO, things of that nature.”

Facility Profile: Overcoming Adversity to Build Case Volumes

Heading into 2006, the Michigan Endoscopy Center in Farmington Hills, Mich., was coming off a year in which it had performed 16,300 cases, a 70/30 mix of lower and upper GI, respectively, in its three procedure rooms and three ORs. In the middle of 2006, one of the original physician members, who had contributed more than 1,000 procedures annually, moved his practice out of state mid-year. Michigan Endoscopy Center managed to still perform 16,100 cases, but needed ways to fill the gap in ’07. Then, it got even tougher: The

equivalent of one full-time physician was lost for nearly half the year due to maternity leave and

back surgery.

Despite being down a physician-and-a-half for 2007, Michigan Endoscopy Center managed to not simply hold steady, but to top the previous two years’ volumes and perform a record 16,500 procedures. And the 5-year-old facility is on track to do 17,000 in 2008.

How did Michigan Endoscopy Center do it?

For one thing, demand is higher than ever for GI procedures, and Michigan Endoscopy Center looked to its coalition of 17 physicians from five off-site practices to fill the space.

“We were proactive in repackaging available block time to the physicians,” says Brien Fausone, MA, MBA, the administrator of Michigan Endoscopy Center. “One of our busy physicians who was on medical leave assigned his patients to one of the junior physicians, which helped preserve some of the volume fallout. Several of the physicians picked up additional days during the five months of open block time.”

In smaller practices, adding another physician might be an option. According to Physicians Endoscopy’s data, credentialing just one additional qualified physician with the ability to perform 500 procedures annually in an existing, profitable GI endoscopy ASC can generate $250,000 in collections a year at a very high profit margin.

That would easily cover the losses incurred by CMS’s restructuring of the ASC payment system. Increasing the ability to perform procedures is one of the major steps Mr. Fausone started preparing last year in an effort to take the sting out of the Medicare GI cuts.

“As a result of the success of offering additional block time and in anticipation of the Medicare reimbursement cuts, the board of managers decided to make the capital investment in opening an additional procedure room late in Q4 of 2007,” he says. “We opened the additional procedure room to give those physicians who had maximized their current block time additional opportunities to scope at MEC. This additional procedure room provides an additional 50 potential cases a week, bumping our daily capacity to 90 cases per day.”

On a more macro scale, Mr. Fausone credits an

“all-star team of employees, both clinical and

non-clinical,” as the driver that allows the physicians to chalk up the large volumes.

“Most of our clinical staff were personally recruited by our physicians when we opened five years ago, and we make a conscious effort to recruit nurses and techs who will fit our busy ASC,” he says. “Most of our clinical staff have many years of experience in GI or surgery and have worked side-by-side with our physicians over many years. This allows our staff to anticipate the needs of the physicians and provide individualized attention based on each physician’s surgical preferences.”

To reward staff for their efforts, “We also provide quarterly bonuses to our staff for various quarterly benchmarks, including quality, patient satisfaction and billing error rates,” says Mr. Fausone. “This is a confirmation from the physician-owners as to the importance of the team in the overall success

of MEC.”

Are You Ahead of the GI QI Curve?

Nearly nine in ten (88 percent) gastroenterologists either currently capture quality indicator data or plan to do so in the next two years, according to a January 2008 independent, national survey of gastroenterologists commissioned by ProVation Medical and Caris Diagnostics. Of those surveyed who collect QI data, majorities cited scope withdrawal time (62 percent) and rate of adenomatous polyp detection (52 percent) as indicators they capture most frequently.

“Scope withdrawal time and adenoma detection are the two biggest indicators, but there’s a little bit of subtlety when looking at those data,” says Sean Benson, the vice president of consulting and co-founder of ProVation Medical. “Scope withdrawal is a poor proxy for what physicians really want, which is adenoma detection rate, but you kind of have to look at them together to really get a good understanding. Rate of reaching the cecum, patients’ ASA classifications, and quality of prep for colonoscopy, are also discussed as important factors to track.”

Here are a few more key points from the QI study on what gets tracked, where, by whom, and how the data is used by gastroenterology facilities:

• More than eight in 10 of the gastroenterologists surveyed capture intraprocedure and post-

procedure QI data (84 percent and 83 percent, respectively), compared to 61 percent who capture pre-procedure data.

• While 64 percent of these gastroenterologists use QI data for comparison purposes, only 4 percent provide QI data to their patients.

• Eighty percent of those who use QI data for comparison purposes are comparing their practice to national benchmarks, and 64 percent use the data to compare physicians within the facility.

• Of those who currently capture QI data, other uses include research (24 percent), marketing (14 percent), negotiation of payor contracts (12 percent), pay-for-performance reimbursement (9 percent), and sharing with referring physicians (9 percent).

• The typical gastroenterologist surveyed is most likely to work in a group practice (49 percent); use a

combination of hospitals and physician-owned ASCs/endoscopy centers to perform procedures; make use of hospital-based pathology labs (69 percent) and offer open-access endoscopy (63 percent), in which patients are scheduled without prior consultation.

• On average, gastroenterologists in this study perform 45 percent of their procedures in a hospital, 34 percent in a physician-owned or partially physician-owned ASC or endoscopy center, and 8 percent in an office setting.

• Though 43 percent of gastroenterologists who collect QI data use procedure-based software to do so, 82 percent overall consider it the preferred method to capture the data.

“To give you an idea of how important QI is becoming, CMS issued the PQRI — about 75 different data elements across all specialties — in July, offering to increase reimbursement by 1.5 percent in return for facilities that capture, report and meet quality benchmarks,” notes Mr. Benson. “A lot of those data are focused on general practitioners, but there has been a lot of talk in the ASC space about CMS’s coming out with new data elements to report on for an extra 2 percent in reimbursement. It could happen as soon as 2009, but even if it’s delayed, this is what the future holds.”

ProVation Medical provides procedure documentation software that tracks QI and supports several medical facilities currently participating in a national QI tracking study currently led by two major gastroenterological societies. Caris Diagnostics is a national, GI sub-specialized anatomic pathology laboratory that has developed the capability to capture and report discrete pathology diagnoses, such as the number of adenomatous polyps, with procedure documentation systems like ProVation MD. The two organizations combined their competencies to support this research effort. The survey was

conducted by Renaissance Research from Jan. 8 to 16; it was completed by 182 gastroenterologists.

8 New GI Products to Know

Radial Jaw 4 Biopsy Forceps

Radial Jaw 4 Biopsy Forceps

Boston Scientific

(888) 272-1001

www.bostonscientific.com

FYI: The Radial Jaw 4 Biopsy Forceps’ new jaw design and micro-mesh tooth configuration provide larger and more consistent samples without the need to use large-channel therapeutic endoscopes. These single-use forceps are also engineered for precise sample identification and enhanced passability through tortuous anatomy and are ideally suited for surveillance biopsies of Barrett’s esophagus or inflammatory bowel diseases due to the increased jaw size and the ability to fit down a 3.2mm working channel.

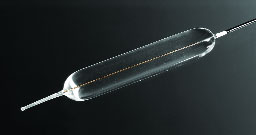

CRE Fixed Wire

CRE Fixed Wire

& Wireguided Balloon Dilators

Boston Scientific

(888) 272-1001

www.bostonscientific.com

FYI: The CRE Fixed Wire Balloon Dilator’s rounded shoulders facilitate visualization while dilating, and give physicians the ability to dilate to three distinct diameters with only one pass of the catheter. The balloon produces high pressures at each diameter and deflates rapidly. Incorporating features from the Fixed Wire Balloon, the Wireguided also includes a preloaded guidewire that facilitates placement within tight strictures and tortuous anatomy. In addition, it may reduce procedure time.

Environ-mate DM6000 Series

Environ-mate DM6000 Series

MD Technologies

(800) 201-3060

www.mdtechnologies.com

FYI: The Environ-mate DM6000-2 Series Suction-Drain system’s compact, wall-mounted unit collects fluids directly from the suction field and disposes directly to the sanitary sewer, providing fluid waste management for endoscopy and preventing exposure to suctioned fluids and reduces expensive disposable supplies. The unit has two independent suction inputs for EGD, ERCP and bronchoscopy procedures, or offers back-up suction in single-field procedures, such as colonoscopies. An optional fluid totalizer records fluid volume aspirated.

Endo Capsule

Endo Capsule

Olympus America

(800) 645-8160

www.enteropro.com

FYI: The Endo Capsule offers high-resolution, a wider field of view and an enhanced depth of view, automatic brightness control, advanced color reproduction and structure enhancement when imaging the small bowel. A portable, lightweight real-time viewer conveniently lets physicians verify the device is fully functional before ingestion, and the capsule can easily be activated or deactivated to conserve battery power. The hands-free, comfortable harness lets patients conduct normal activities while the capsule records images.

EPK-i Digital Image Processor

EPK-i Digital Image Processor

Pentax Medical

(800) 431-5800

www.pentaxmedical.com

FYI: The EPK-i features high-resolution, progressive-scan still imagery and video. Since it is built on computing technology, the digital EPK-i images can be filtered (at the touch of a button for surface, contrast and tone enhancements), giving doctors varying views of vascularity and surface irregularities that may increase rates of problematic tissue detection. The EPK-i can record and report procedure timestamps that can be analyzed and benchmarked for improving unit efficiencies and lab flow management.

90 i-Flex Endoscopes

90 i-Flex Endoscopes

Pentax Medical

(800) 431-5800

www.pentaxmedical.com

FYI: The ergonomically engineered 90 i-FLEX endoscopes, give physicians increased capabilities for problematic tissue detection and increased maneuverability and intraoperative patient comfort. The 90i i-FLEX boasts 1 megapixel diction power for still and image video capture, the highest resolution on the market. All i-FLEX models are built on the revolutionary, three-phase PENTAX “Cecum Finder” variable graduated stiffness scope platform, resulting in up to nearly 25 percent faster times to the cecum. With significantly improved engineering in illumination, accessory and air/water channels (including a powerful forward water jet) — without increasing the tip diameter, the 90 i-FLEX scopes provide unparalleled productivity and patient care.

Endo-Ease Discovery

Spirus Medical

(781) 297-7220

www.spirusmed.com

FYI: The single-use Endo-Ease Discovery SB has a 115cm working length to aid advancement through the small bowel with gentle rotation. The spiral naturally follows the lumen of the small bowel as it is rotated with gentle forward pressure and offers the option to stabilize the small bowel at any point the physician chooses while the scope is independently advanced. The Discovery lightly connects to an existing pedi-colonoscope and rotates independently to preserve visual perspective.

SDC Ultra

Stryker Endoscopy

(800) 624-4422

www.stryker.com

FYI: The SDC Ultra is the first HD Capture Device for minimally invasive surgery with the ability to capture video in native HD format. The unit features an intuitive user interface, two channels of video inputs, patient scheduling and DVD and USB burning formats. The SDC Ultra can support a broad spectrum of surgeons using HD recording and Dual Channel Video input support, while offering simple, effective image and video capture for archiving purposes.