The ambulatory surgery center industry continued significant levels of acquisition activity in 2014, and acquisition activity is expected to remain high for 2015, according to the HealthCare Appraisers "2015 ASC Valuation Survey."

In the survey 71 percent of the ASC company respondents acquired at least one ASC, with 24 percent reporting the acquisition of between six and 10 centers. For 2015, 60 percent of respondents plan to purchase between one and five ASCs, and 25 percent plan to purchase between six and 10 ASCs.

Valuation multiples

Controlling Interests

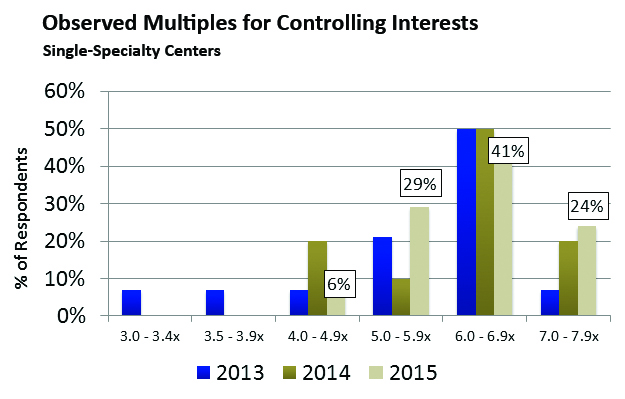

Valuation multiples for single-specialty ASCs reported by respondents in the 2015 Survey shifted higher overall, with 24 percent reporting multiples of 7.0 to 7.9 times EBITDA, versus 20 percent in the prior year's survey. However, as set forth in the following graph, there were some shifts in the 4.0 to 4.9 times (i.e., fewer), 5.0 to 5.9 times (i.e., more), and 6.0 to 6.9 times (fewer).

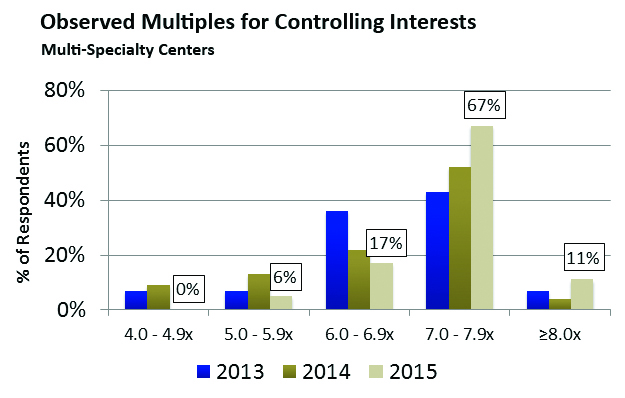

In addition, multiples for multispecialty ASCs are comparatively higher than those reported in the previous survey. According to the current survey, 78 percent reported multiples of 7.0 to +8.0 times EBITDA for controlling interests in multispecialty ASCs, versus 56 percent in the prior survey.

Minority (non-controlling) Interests

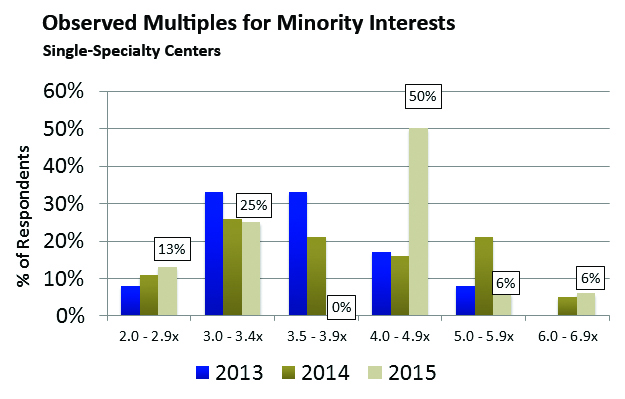

Multiples for non-controlling interests are significantly lower than their controlling interest counterparts, as a buyer is willing to pay less for an interest that lacks certain prerogatives of control (i.e., conversely, buyers pay premiums for interests which carry with them control rights). As set forth in the following graph, single specialty minority interest multiples generally range between 4.0 and 4.9 times, with the increase predominantly coming from 3.5 to 3.9 times in the prior survey.

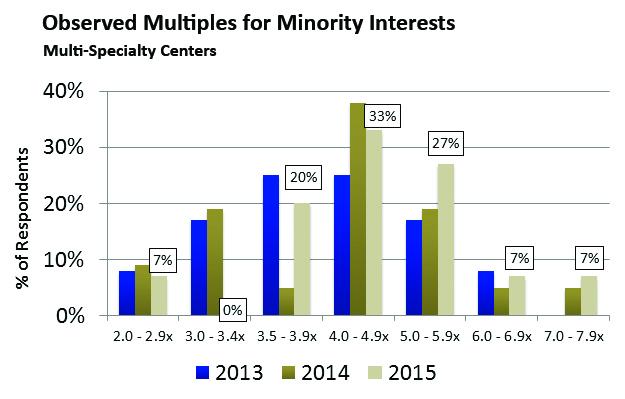

Similar to controlling interest multiples, multispecialty minority interest multiples are higher than their single specialty counterparts, with 27 percent of the respondents reporting multiples between 5.0 and 5.9 times versus 6 percent for single specialty. Furthermore, based upon the results of this year's survey, multispecialty multiples have generally increased over the prior year.

Industry Forces

Consolidation

"While we observe a diminishing growth rate for new ASCs and continued pricing pressures, we continue to see robust transactional activity in a maturing industry, which we note is still largely unconsolidated. According to a recent article published by Medical Research Consultants, independent ASCs capture approximately $24 billion, roughly 63 percent of the market share.1 In the past several years, we have witnessed some sizable consolidation activity," says Todd Mello, ASA, CVA, MBA, Partner and Co-Founder of HealthCare Appraisers:

1. AmSurg’s acquisition of National Surgical Care in 2011;

2. Graymark Healthcare's acquisition of Foundation Surgical Hospital Affiliates and Foundation Surgery Affiliates in 2013;

3. Surgery Partners' acquisition of Symbion in 2014; and

4. Tenet Healthcare's acquisition of USPI in early 2015.

"The increased competition for ASCs (i.e., Mello notes that 60 percent of respondents reported increasing acquisition activity and 45 percent reported increasing competition for deals) continues to drive prices up, and recent large transactions (e.g. Symbion) suggest multiples paid of 10 times or more for companies with a large presence in the space. Considering that one can purchase a multispe¬cialty center at a multiple of 7 to 8 times EBITDA, these transactions still appear to be accretive to the acquirer."

Hospital Acquisitions, Healthcare Reform and Physician Employment

Hospitals have continued to increase their prowess within the ASC industry. Tenet's combination with United Surgical Partners to become the largest provider of ambulatory surgery in the United States is one primary example. Additional health systems, for-profit and not-for-profit, also continue to look for opportunities within the ASC sector and compete with other non-hospital buyers.

"Hospitals' continuing efforts to acquire physician practices and employ physicians is also taking its toll on the industry," Mr. Mello notes. "According to MGMA's 2014 Physician Compensation and Production Survey (i.e., based on 2013 data), over 63 percent of responding physician practices are owned by hospitals or integrated delivery systems, up from 34 percent in 2008. In addition, 67.5 percent of responding internal medicine physicians are hospital-owned, up from approximately 51 percent in 2009. Furthermore, according to the 2014 Review of Physician and Advanced Practitioner Recruiting Incentives, which examines over 3,000 permanent physician recruiting assignments that Merritt Hawkins/AMN Healthcare had ongoing or were engaged to conduct between April 1, 2013 and March 31, 2014, 64 percent of newly hired physicians are employed by hospitals, up from 11 percent in 2004. Though lagging behind, most specialists are on the same path towards employment. According to MGMA, over 51 percent of orthopedic surgery respondents are hospital owned, up from 31 percent in 2009. As, health systems continue to acquire physician practices in part in preparation for risk-based contracting arising from healthcare reform, the impact to independent surgeons and ASCs is potentially significant," notes Mr. Mello.

1. Primary care physicians who are employed by a hospital or health system are strongly encouraged to refer to specialists who are also employed, thus possibly reducing referrals to unaffiliated surgeons.

2. Surgeons who become employed are oftentimes precluded from doing cases in a free-standing ASC to the extent the ASC is not affiliated with the hospital. Accordingly, free-standing ASCs are finding it harder and harder to attract new surgeons to maintain the long-term viability of their ASCs.

3. Free-standing ASCs are oftentimes acquired and cease to operate on a free-standing basis, either through outright closure or conversion to hospital outpatient departments.

Other Notable Findings

Management Fees

ASC company management fees have ranged from 5 percent to 7 percent of ASC net revenue for the past several years, and that trend continued in the most recent survey, where 69 percent of respondents in this year's survey reported that their typical management fees range from 5 percent to 6 percent. However, contrary to expectation, the proportion of respondents charging management fees of 7 percent increased year-over-year, while that proportion charging 4 percent also increased.

"If you are competing against other managers/buy¬ers and charge a higher percentage of net revenue in management fees, you may be disadvantaged," says Mr. Mello. "Additionally, ASC owners often want to lower the percentage over time. The hardest work is generally in the first couple of years — that's when the company spends the most resources to make sure the ASC per¬forms well. Then the ASC companies' profit margins typically go up. But once the ASC runs smoothly they typically don't need as much support from the manage¬ment company."

Many contracts have minimum management fees, with 72 percent of respondents reporting minimum fees between $100,000 and $300,000 per year. Similarly, for the reasons mentioned above, 40 percent of the respondents reported having arrangements where the management fee rate varies based on the level of revenue generated by the ASC. Thirty-eight percent of those reporting such variation provisions in their management agreements report ASC revenue thresholds for decreasing management fees ranging between $10 million and $14 million (i.e., at these revenue levels, the ASC manager would consider reducing its standard management fee).

"At risk" Management Fees

The trend within the inpatient setting to tie compensation, in part, to the achievement of pre-established performance and quality metrics, which is consistent with the direction of healthcare reform, is still lagging within the ASC industry. Only 15 percent of respondents reported that some portion of their management fee is "at risk."

"While there is still much uncertainty surrounding the future of healthcare delivery and reimbursement, I think within the next several years we will see more pressure to introduce quality and performance-based metrics into ASC management fees," noted Mr. Mello. "As ASC industry participants continue to evaluate ways to align with hospitals for the delivery of cost-effective, coordinated inpatient and outpatient care in the wake of healthcare reform, I believe it's only inevitable."

1. http://www.mrchouston.com/ambulatory-surgery-centers-ripe-for-consolidation/