In December 2016, Regent Surgical Health, a leading developer and manager of ambulatory surgical centers (ASCs), underwent an ownership transition: it sold 100% of its common stock to its employees through the establishment of an employee stock ownership plan (ESOP).

“The owners and investors of Regent considered various strategic financial alternatives as we evaluated the proper ownership transition of the business including the sale of the company to a strategic or financial buyer. We ultimately chose to sell the business to the employees – our true partners – so they can directly participate as owners in the future financial benefits of executing our successful business model.”

- Regent Co-Founder and Chairman, Tom Mallon

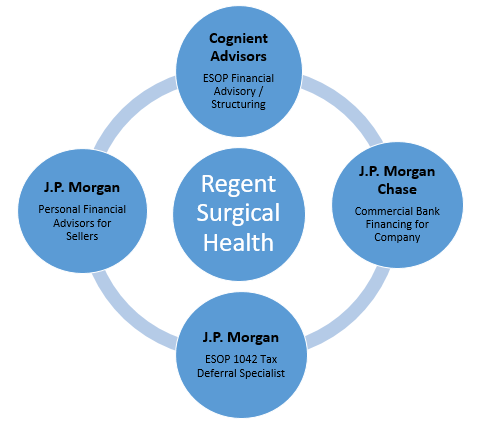

The ownership transition to an ESOP was a natural evolution for the organization, which started out as an employee-owned company with multiple founders, and had been operating as a partnership since its founding in 2002. Regent worked with Cognient Advisors, a Chicago-based ESOP financial advisory firm, to begin the process. The first step was to structure a plan which included determining an appropriate value of the business and assessing the capital funding configuration in the context of an ESOP transaction.

Dan Bayston, Managing Director with Cognient, commented, “The significant tax advantages provided to the sellers of the company as a 100% employee-owned S Corporation made the ESOP alternative the right transition solution. It will provide significant financial flexibility and value to the business in the future.”

In financing the transaction, the Regent partners looked to J.P. Morgan’s Commercial Bank for senior debt financing. Eric Zaiman with the bank’s ESOP Advisory Group understood that healthcare capabilities were vital for Regent as it underwent this important transition. They worked closely with the J.P. Morgan For-Profit Healthcare industry team to structure a revolving line of credit and term loan solution for the company. This customized financing provided the necessary level of working capital while complimenting debt provided by outside investors.

Sellers to ESOPs are allowed to defer any capital gain recognition on proceeds of a sale so long as certain procedures are followed regarding the use of the proceeds. This is referred to as the ESOP 1042 tax deferral and is so named after the relevant section in the Internal Revenue Code, which allows for the advantage.

To facilitate the ESOP 1042 tax deferral, Regent looked to J.P. Morgan ESOP specialist, Brian Jenkins. Jenkins and his team provided the expertise to navigate the Internal Revenue Code requirements and implement a customized tax deferral solution. Each Regent seller is able to invest in a tailored portfolio of securities, known as Qualified Replacement Property (QRP), and defer all applicable state and federal capital gain taxes. They then have the option to borrow against the portfolio and use unencumbered funds for personal use or make other investments. Any portion of the QRP portfolio held through the seller’s lifetime will receive a step-up in cost basis at the time of their passing.

Going forward, J.P. Morgan Financial Advisors Daniel Resnick and Brian Driscoll, have the ability to work closely with sellers to understand their personal goals and objectives at every phase of their lives. This personalized analysis leads to the design of a goal-based plan and helps implement a diversified investment strategy to enable each seller to achieve their long term goals and objectives.

By establishing an ESOP and taking advantage of the tax deferral, the founders of Regent Surgical Health were able to maintain the cherished legacy of private ownership, reward their loyal employees, and realize a net selling price that was competitive to offers from strategic and financial buyers. A true win for the founders and their partners!

The views, opinions and positions expressed within these guest posts are those of the author alone and do not represent those of Becker's Hospital Review/Becker's Healthcare. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.