Vascular Access Centers (“VACs”) are outpatient facilities that specialize in access maintenance for patients with end stage renal disease (“ESRD”).

ESRD patients that develop vascular access problems as a result of dialysis, such as prolonged bleeding, inadequate blood flow, or increased venous pressure may require treatment in a VAC. Approximately 80.3% of ESRD dialysis patients are treated via catheter, and as a result VACs also play a critical role in reducing the hospitalization of ESRD patients by allowing non-emergency interventional procedures to be performed in an outpatient setting. For patients who do not have ESRD, VACs may offer an alternative setting for other interventional vascular procedures including access for medical oncology, Peripheral Arterial Disease (“PAD”), and enteral nutritional and medicine delivery, among others.

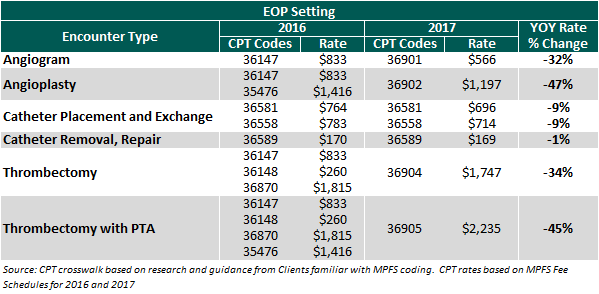

VACs are frequently operated under an Extension of Practice (“EOP”) model whereby procedures are performed and billed as an in-office ancillary service of the physician practice and reimbursed under the Medicare Physician Fees Schedule (“MPFS”). Beginning January 1, 2017, changes in the MPFS resulted in significant reimbursement cuts for several commonly performed vascular access procedures, and as a result, VACs operated under the EOP model will see profits decline significantly. As shown in the table below, the bundling of certain CPT codes and reductions in the fee schedule reduced reimbursement for certain VAC procedures by as much as 47%.

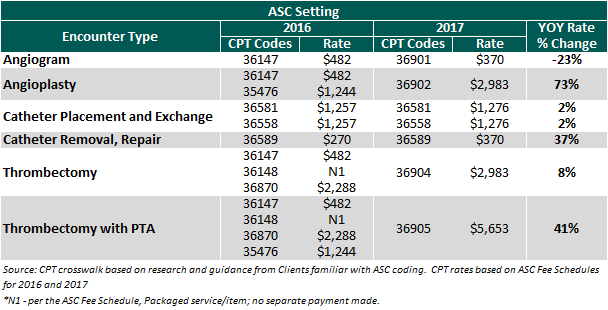

Despite the reductions in vascular access reimbursement under the MPFS, reimbursement increased for vascular access under the 2017 ASC fee schedule. As a result, many of the VAC procedures are now more economically viable in an ASC setting. See the below table summarizing the rate changes from 2016 to 2017 in an ASC setting.

Billing for vascular access in the EOP setting is done globally (includes both professional and technical components of reimbursement), and ASC billing includes only the ancillary technical component (and has multi-procedure discounting). As a result, a cross-walk of reimbursement from an EOP to an ASC requires a fair amount of analysis, however, some VACs may experience an increase in technical reimbursement of 40% or more in an ASC setting. Not surprisingly, many VACs that currently operate as an EOP are evaluating the viability and legal permissibly of a conversion to an ASC and the costs associated with doing so. For investors in VACs, this also presents an important cost-benefit analysis that may have a significant impact on the value of the center.

In-Office Ancillary Carve-Out

The valuation of any in-office ancillary service line is highly nuanced, subject to significant regulatory risk, and requires detailed analysis to properly identify and allocated revenue and expenses between the professional practice and the ancillary service.

The first step in the valuation of the VAC is to perform coding analysis to isolate the ancillary technical component of revenue. As mentioned above, VACs operated as an EOP bill globally, but when valuing the service line as a carve-out, the professional component of revenue remains with the practice and should not be included in the valuation of the VAC. In addition to globally billed procedures, in a VAC operated as an EOP the participating physicians may perform services in the center such as office visits or consults that are not typically associated with standalone ancillary businesses, and these services should also be reallocated to the professional practice when valuing the VAC.

The second step is to clearly identify the direct and indirect costs associated with the operations of the VAC. For centers that have separate financial reporting, or for centers located in a separate and distinct physical space, identification of costs may be done more easily, however, it is often the case that staff and other operating expenses may not be clearly delineated between the VAC and practice. Careful identification of the expenses necessary to support the VAC on a standalone basis is critical to proper valuation.

Lastly, it is necessary to identify the equipment and other assets associated with the VAC, which may be comingled with the asset register for the practice. This can be done via physical inventory and appraisal, or with help from the practice to identify assets on the register that are associated with the VAC.

Once these steps are performed, a restated P&L and balance sheet can be created and the VAC can be valued using traditional methodologies like the Discounted Cash Flow (DCF) Method. Using the existing fee schedule and payor rates in this model will establish a baseline to evaluate existing value and the cost-benefit of conversion.

Valuation Considerations for Conversion

To determine the feasibility of conversion and the associated value proposition of doing so, it is critical to understand the anticipated uptick in revenue, direct out of pocket costs, timing, risks, and other considerations that may impact the center. Key considerations include, but are not limited to, the following:

• Certificate of Need (if applicable): Depending on the state in which the center operates, a Certificate of Need (“CON”) may be required to operate as an ASC. Further, the availability or ability to obtain a CON can vary drastically by county. Depending on the process required for the particular market, this could add significant costs, timing delays, or prevent conversion altogether.

• Development and Construction Costs: Depending upon the location and layout of the current facility, physical relocation may or may not be required in order to meet the requirements for an ASC. Even when relocation is not required, significant capital expenditures may be required to upgrade the facility, which could easily amount to a couple hundred thousand dollars. Such costs may include architectural design and state plan review, construction management, permitting, HVAC and electrical upgrades, accessibility improvements, and equipment upgrades. In some instances, the VAC may need to cease operation for a period of time as these improvements are being made, adding opportunity cost and lost revenue to the development process.

• Medicare Approval: Gaining Medicare approval can be a time intensive process. An understanding of the approval process, requirements, and timeline is critical. It should also be noted that procedures performed during the approval process may not be billed, adding cost to the process.

• Coding Crosswalk: As discussed above, there were significant changes to the fee schedules in 2017, including bundling of codes and significant reimbursement changes. In developing projections for a center through a transition from EOP to ASC, this is arguably one of the most critical components of evaluating the conversion.

• Reimbursement: If converted to an ASC, the center will need to negotiate new payor contracts with commercial insurers and may need to operate out of network for some period of time. The rates that will ultimately be paid as a result of these contract negotiations are uncertain, and for valuation purposes the use of Medicare rates as a starting benchmark may be most appropriate.

• Risk: Each of the elements above have a high degree of uncertainty, and a change in any one of the assumptions could have a material impact on the viability of conversion and value proposition. To account for this the appraiser should use a rate of return in the valuation model that accounts for this additional risk. This rate of return should be in excess of that used to value the center as an EOP, and the magnitude of the premium should reflect the degree of variability and potential magnitude of a deviation from expectations.

Incorporating the revised assumptions above into an alternate DCF scenario, a comparison can be made to the value of the VAC as an EOP versus an ASC. If the value as an ASC on a risk adjusted basis is higher than the indication of value as an EOP, and conversion is viable, Fair Market Value should be determined using the alternative scenario.

Given the recent reimbursement changes for vascular access, it is critical to understand all of the moving parts and value-drivers when valuing a VAC. It would be prudent for a valuator to seek guidance from informed market participants and operators when possible to thoroughly understand all the pertinent risks, timing, and costs of a transition.

Brad Brumbaugh, CFA, CBA, CMEA is a manager in the Business Valuation Services Division of VMG Health in the Denver office, where he provides valuation, transaction advisory, and consulting services to clients within the healthcare services industry.

Jason Ruchaber, CFA, ASA is a Managing Director and the Denver office leader of VMG Health where he advises health lawyers, health system executives, physicians, and other healthcare industry stakeholders on healthcare-related valuation issues.

The views, opinions and positions expressed within these guest posts are those of the author alone and do not represent those of Becker's Hospital Review/Becker's Healthcare. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.