In markets where favorable managed care contracts are difficult to secure, ASCs have turned to an out-of-network primary billing strategy over the past decade. While an out-of-network strategy may be a lucrative alternative to less preferable contract reimbursement rates for some ASCs, the strategy often presents both buyers and sellers of ASCs with several challenges.

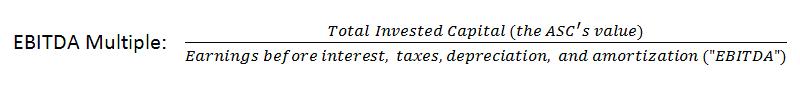

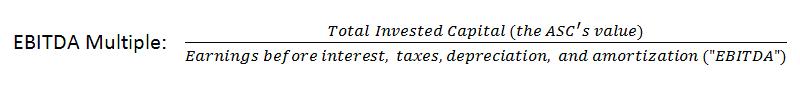

To better understand the market for out-of-network surgery centers, we examined valuation multiples on both the minority and control levels for out-of-network ASCs. We then compared these multiples to in-network ASC multiples over the past five years. For our dataset, we examined the price paid for a surgery center relative to its total earnings before interest, taxes, depreciation, and amortization (“EBITDA”):

Data Process

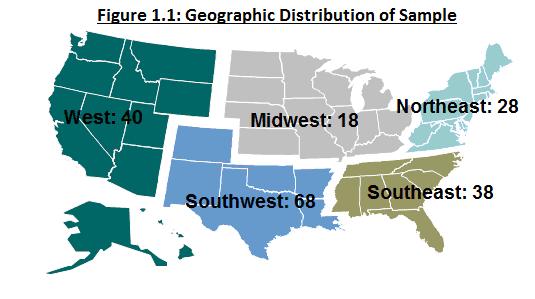

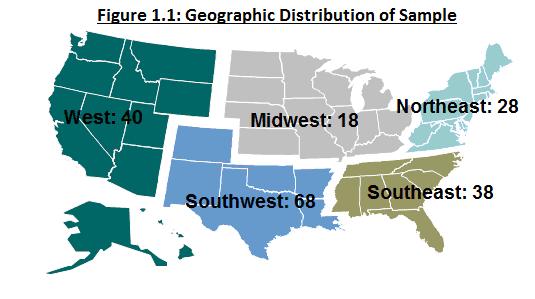

Over the past five years, VMG Health has valued more than 1,200 ASCs, ranging from single-specialty locations to large, multispecialty surgery centers. In the study, both in-network and out-of-network ASC transactions at both the minority and control levels were examined. The preliminary dataset consisted of both VMG Health's internal transaction database and publicly disclosed ASC EBITDA multiples. The dataset was first narrowed by quality of data and then further scrubbed to remove outlier transactions. The final dataset included 192 ASC transactions across the country.

After identifying the final dataset, each multiple was categorized by interest type (minority or control) and then by each center’s billing strategy (either in-network or out-of-network). Lastly, each multiple was categorized by year, each year’s multiple was averaged and the EBITDA multiples were valued over time.

Findings and Analysis

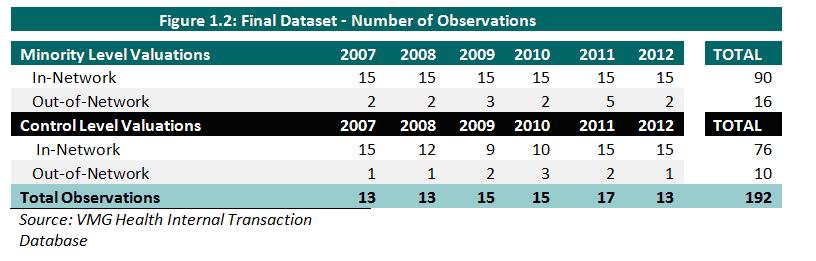

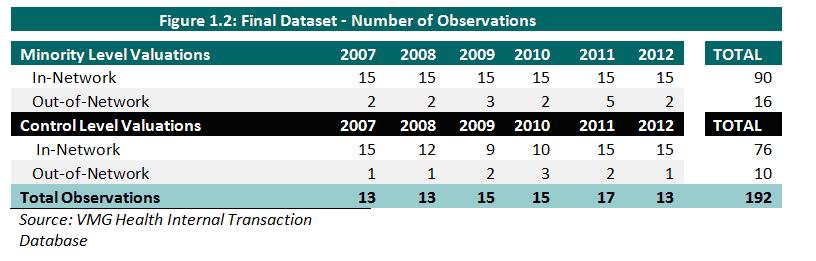

Our research resulted in a total of 106 minority-level valuations and 86 control-level valuations from 2007 to 2012. While the database of transactions contained hundreds of in-network valuations, out-of-network transactions were less common, thus limiting the sample size. As the data in Figure 1.2 indicates below, the transaction market for out-of-network ASCs was most active in 2010 and 2011.

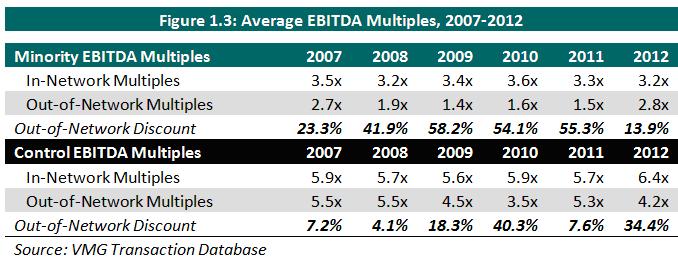

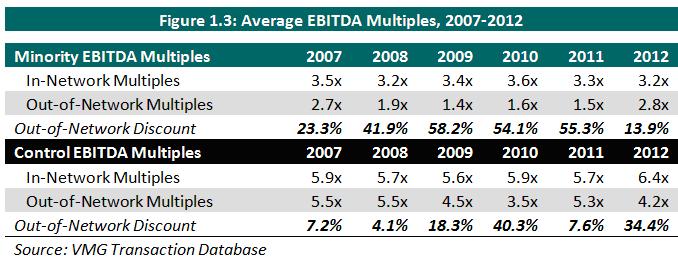

Figure 1.3 details each dataset’s average EBITDA multiples from 2007-2012. To better understand this data, it’s best to look at minority and control multiples separately.

Minority Transactions – Are Physicians Still Risk Averse?

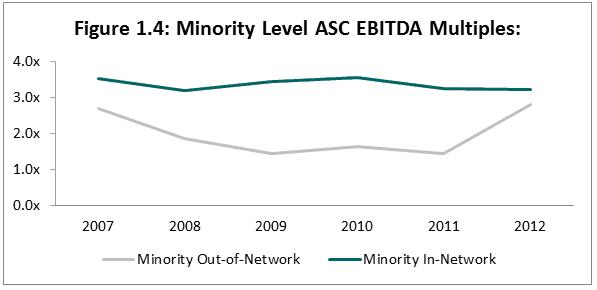

Out-of-network minority transactions generally transact at lower multiples of EBITDA than their in-network peers. In the first year of the sample, out-of-network minority ASCs on average transacted at EBITDA multiples reflecting a 23 percent discount from similar in-network ASCs. From 2009 to 2011, the gap between in-network and out-of-network minority transactions widened substantially. By 2011, out-of-network ASCs within our dataset were trading at a 55 percent discount compared to similar in-network centers.

The widening of multiple ranges over time may be explained by investor risk appetites. In most markets, out-of-network ASC investments are risky endeavors. In order to maintain sustained elevated reimbursement, out-of-network ASC managers must be skilled negotiators, employ an effective marketing strategy, or be revenue cycle experts. Since minority shareholders of ASCs typically do not have the ability to make these decisions, physician investments in out-of-network centers are more risky and have become less attractive, thus lowering the underlying EBITDA multiples.

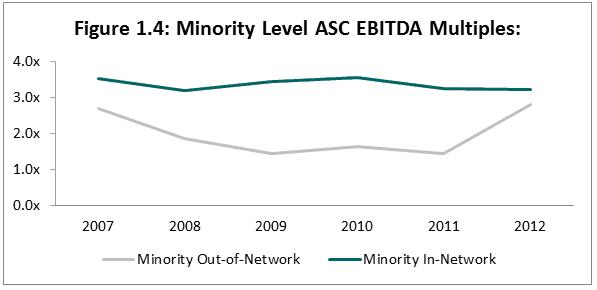

However, as illustrated in Figure 1.4 above, minority interests in out-of-network ASCs became more valuable in 2012. Though it’s impossible to attribute the uptick in out-of-network multiple ranges to one factor, the increase in multiple values may indicate that physicians are once again looking to invest in higher-risk centers with the prospects of higher returns. Minority out-of-network ASCs typically transact anywhere from 1.5 to 3.0 times EBITDA, while in-network minority interests typically transact anywhere from 3.0 to 4.0 times trailing 12 months EBITDA.

Control Transactions – Great Expectations in a Rare M&A Environment

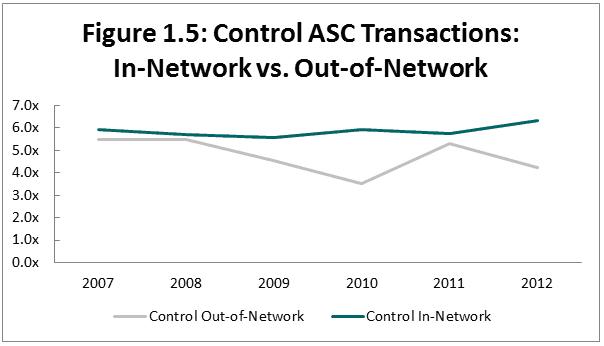

As mentioned previously, the dataset for control-level out-of-network transactions is limited. This lack of transaction data at the control level can be explained by challenges that buyers and sellers of such ASCs face during negotiations. Fewer out-of-network centers exist than in-network centers, and out-of-network deals don't transact nearly as often as their in-network peers. One reason for this is that buyers typically assume market forces will cause a center to change its billing strategy from out-of-network to in-network after a transaction. When converting an out-of-network center to in-network, a buyer will typically shift projected reimbursement to managed care contracted rates, which are typically lower than out-of-network rates. Sellers often experience "sticker shock" caused by these lowered reimbursement projections, which causes them to decide to hold their interests until market forces require them to move in-network, and thus often walk away from the deal at hand. Since buyers and sellers of out-of-network ASCs struggle to find common ground or "a meeting of the minds" during transaction negotiations, these types of transactions are typically very rare in practice.

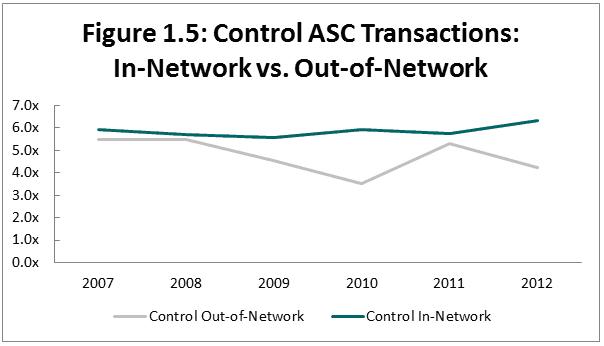

As Figure 1.5 illustrates, the discount for out-of-network ASCs compared to in-network ASCs is substantially less at the control level than the minority level. While these deals occur less frequently than in-network ASC buyouts, the out-of-network discount is lower for control-level ASCs than for minority-level transactions. For transactions within the control-level dataset, control-level buyers can typically guide the management and billing decisions of an ASC. Since these control rights can play a large role in the success of a center's out-of-network strategy, the premium for in-network centers is typically less than what is seen in minority multiples.

Estimating a Control Multiple

Since out-of-network control-level transactions for ASCs occur infrequently, buyers and sellers can estimate a general multiple for a potential deal. Since these types of centers are difficult to sell and usually expected to be brought in-network, sellers can typically expect a value range anywhere from 3.5-5.0 times EBITDA. This multiple range is typically about 25 to 35 percent lower than the control-level EBITDA multiples for centers that are already in-network.

Summary and Conclusion

Due to the ASC transaction market's suppressed aversion to risk and the difficulties associated during transaction negotiations, out-of-network ASCs will continue to demand lower transaction multiples. These lower multiples often reflect the higher risks associated with maintaining historical healthy EBITDA margins and favorable reimbursement rates for out-of-network centers. While valuation multiples may be lower for these centers, ASCs in certain markets still offer physicians, health system developers, and ASC managers lucrative investment opportunities. For buyers and sellers of out-of-network surgery centers, it is crucial for both parties understand the risks surrounding a given transaction.

More Articles on Surgery Centers:

7 Recent ASC Industry Leadership Changes

ASC QI Projects: Best Ideas for Biggest Impact

Eliminate the Weak Links in Supply Chain: 4 Core Points

To better understand the market for out-of-network surgery centers, we examined valuation multiples on both the minority and control levels for out-of-network ASCs. We then compared these multiples to in-network ASC multiples over the past five years. For our dataset, we examined the price paid for a surgery center relative to its total earnings before interest, taxes, depreciation, and amortization (“EBITDA”):

Data Process

Over the past five years, VMG Health has valued more than 1,200 ASCs, ranging from single-specialty locations to large, multispecialty surgery centers. In the study, both in-network and out-of-network ASC transactions at both the minority and control levels were examined. The preliminary dataset consisted of both VMG Health's internal transaction database and publicly disclosed ASC EBITDA multiples. The dataset was first narrowed by quality of data and then further scrubbed to remove outlier transactions. The final dataset included 192 ASC transactions across the country.

After identifying the final dataset, each multiple was categorized by interest type (minority or control) and then by each center’s billing strategy (either in-network or out-of-network). Lastly, each multiple was categorized by year, each year’s multiple was averaged and the EBITDA multiples were valued over time.

Findings and Analysis

Our research resulted in a total of 106 minority-level valuations and 86 control-level valuations from 2007 to 2012. While the database of transactions contained hundreds of in-network valuations, out-of-network transactions were less common, thus limiting the sample size. As the data in Figure 1.2 indicates below, the transaction market for out-of-network ASCs was most active in 2010 and 2011.

Figure 1.3 details each dataset’s average EBITDA multiples from 2007-2012. To better understand this data, it’s best to look at minority and control multiples separately.

Minority Transactions – Are Physicians Still Risk Averse?

Out-of-network minority transactions generally transact at lower multiples of EBITDA than their in-network peers. In the first year of the sample, out-of-network minority ASCs on average transacted at EBITDA multiples reflecting a 23 percent discount from similar in-network ASCs. From 2009 to 2011, the gap between in-network and out-of-network minority transactions widened substantially. By 2011, out-of-network ASCs within our dataset were trading at a 55 percent discount compared to similar in-network centers.

The widening of multiple ranges over time may be explained by investor risk appetites. In most markets, out-of-network ASC investments are risky endeavors. In order to maintain sustained elevated reimbursement, out-of-network ASC managers must be skilled negotiators, employ an effective marketing strategy, or be revenue cycle experts. Since minority shareholders of ASCs typically do not have the ability to make these decisions, physician investments in out-of-network centers are more risky and have become less attractive, thus lowering the underlying EBITDA multiples.

However, as illustrated in Figure 1.4 above, minority interests in out-of-network ASCs became more valuable in 2012. Though it’s impossible to attribute the uptick in out-of-network multiple ranges to one factor, the increase in multiple values may indicate that physicians are once again looking to invest in higher-risk centers with the prospects of higher returns. Minority out-of-network ASCs typically transact anywhere from 1.5 to 3.0 times EBITDA, while in-network minority interests typically transact anywhere from 3.0 to 4.0 times trailing 12 months EBITDA.

Control Transactions – Great Expectations in a Rare M&A Environment

As mentioned previously, the dataset for control-level out-of-network transactions is limited. This lack of transaction data at the control level can be explained by challenges that buyers and sellers of such ASCs face during negotiations. Fewer out-of-network centers exist than in-network centers, and out-of-network deals don't transact nearly as often as their in-network peers. One reason for this is that buyers typically assume market forces will cause a center to change its billing strategy from out-of-network to in-network after a transaction. When converting an out-of-network center to in-network, a buyer will typically shift projected reimbursement to managed care contracted rates, which are typically lower than out-of-network rates. Sellers often experience "sticker shock" caused by these lowered reimbursement projections, which causes them to decide to hold their interests until market forces require them to move in-network, and thus often walk away from the deal at hand. Since buyers and sellers of out-of-network ASCs struggle to find common ground or "a meeting of the minds" during transaction negotiations, these types of transactions are typically very rare in practice.

As Figure 1.5 illustrates, the discount for out-of-network ASCs compared to in-network ASCs is substantially less at the control level than the minority level. While these deals occur less frequently than in-network ASC buyouts, the out-of-network discount is lower for control-level ASCs than for minority-level transactions. For transactions within the control-level dataset, control-level buyers can typically guide the management and billing decisions of an ASC. Since these control rights can play a large role in the success of a center's out-of-network strategy, the premium for in-network centers is typically less than what is seen in minority multiples.

Estimating a Control Multiple

Since out-of-network control-level transactions for ASCs occur infrequently, buyers and sellers can estimate a general multiple for a potential deal. Since these types of centers are difficult to sell and usually expected to be brought in-network, sellers can typically expect a value range anywhere from 3.5-5.0 times EBITDA. This multiple range is typically about 25 to 35 percent lower than the control-level EBITDA multiples for centers that are already in-network.

Summary and Conclusion

Due to the ASC transaction market's suppressed aversion to risk and the difficulties associated during transaction negotiations, out-of-network ASCs will continue to demand lower transaction multiples. These lower multiples often reflect the higher risks associated with maintaining historical healthy EBITDA margins and favorable reimbursement rates for out-of-network centers. While valuation multiples may be lower for these centers, ASCs in certain markets still offer physicians, health system developers, and ASC managers lucrative investment opportunities. For buyers and sellers of out-of-network surgery centers, it is crucial for both parties understand the risks surrounding a given transaction.

More Articles on Surgery Centers:

7 Recent ASC Industry Leadership Changes

ASC QI Projects: Best Ideas for Biggest Impact

Eliminate the Weak Links in Supply Chain: 4 Core Points