The ambulatory surgery center industry was active in 2013, according to the HealthCare Appraisers "2014 ASC Valuation Survey." Fifty-two percent of the ASC company respondents performed due diligence on up to 10 ASCs, and 44 percent performed due diligence on 11 or more acquisition opportunities last year.

Higher multiples

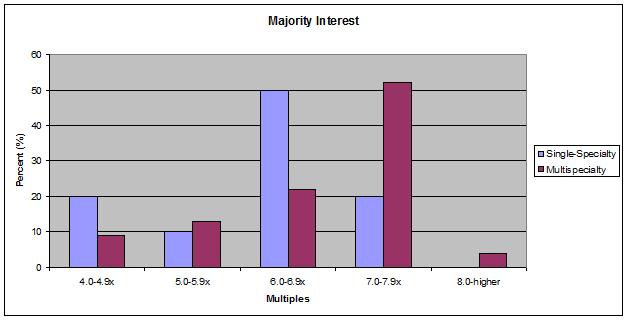

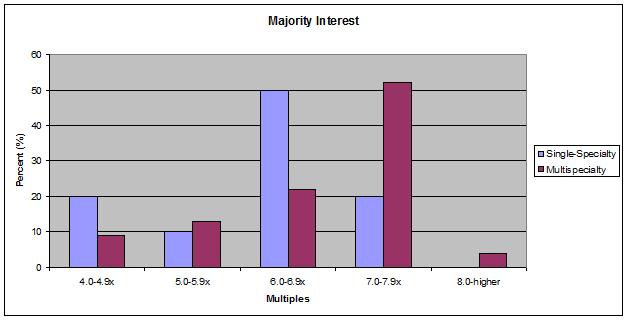

The ASC industry has matured over the last decade, and changes in reimbursement, consolidation, and an aging and dwindling physician investor pool would suggest new buyers would pay lower multiples than in the past; however, the opposite occurred last year. Seventy percent of the survey respondents reported prevailing valuation multiples of 6.0 to 7.9 times EBITDA when purchasing a controlling interest in a single-specialty ASC. For multispecialty ASCs, 58 percent reported prevailing valuation multiples of 7.0 to +8.0 times EBITDA.

When compared with the previous survey — which 57 percent of respondents reported 6.0 to 7.9 times EBITDA for controlling interests in single-specialty ASCs, and 50 percent reported multiples of 7.0 to +8.0 times EBITDA for controlling interests in multispecialty ASCs — the price is going up.

"We have new surgery center companies sprouting up and others going or planning to go public, and people in industry think in the next four to five years there are still good opportunities to make money with ASCs," says Todd Mello, ASA, CVA, MBA, Partner and Co-Founder of HealthCare Appraisers. "The increased competition is driving prices up, and publicly traded surgery center management companies are transacting at 11 times EBITDA as seen in the Surgical Care Affiliates IPO late last year. Considering that one can purchase a multispecialty center at a multiple of 7 to 8 times EBITDA, this is still a good deal for the acquirer."

Becoming a publicly traded company opens up a new source of capital to fuel further growth for ASC companies; whereas, some private companies are more limited in their transactions and tend to manage their limited capital more judiciously.

"They don't want to spend it all on one deal," says Mr. Mello. "If you are an individual — or group of people — that has assembled seven to 10 centers, you become a very attractive target to buyers. Industry participants oftentimes can purchase a handful of marginal centers, make them profitable through additional syndication and business acumen, and then sell them to someone else."

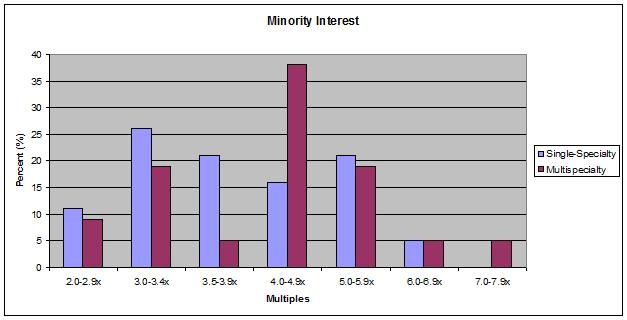

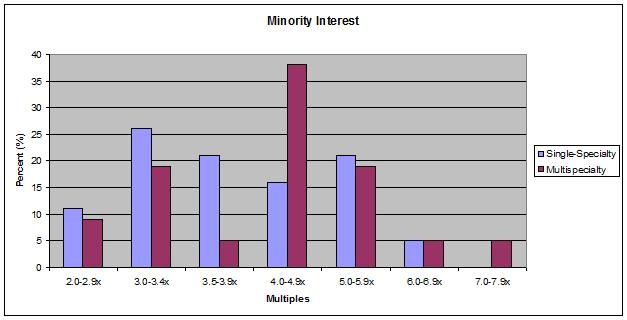

Single-specialty vs. multispecialty centers

Typically, multispecialty centers attract higher multiples than single-specialty centers; it boils down to a diversification issue. If reimbursement for one specialty goes down, the impact could be devastating for single-specialty centers, while multispecialty centers could weather the transition more easily.

The valuation multiples for in-network single and multispecialty ASCs in the last 12 months were reported as:

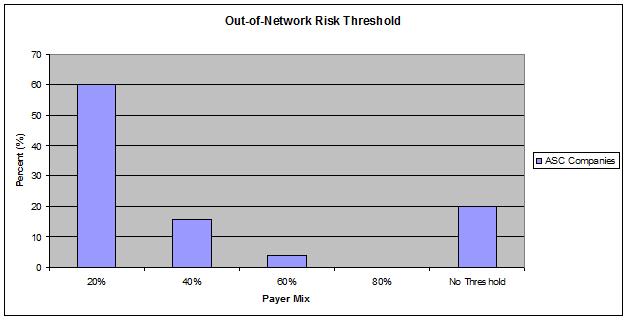

Out-of-network impact

Typically, out-of-network centers are valued using lower multiples than in-network centers, but this is not universally true and oftentimes is geography specific. For example, in a market with one hospital and one ASC, where the ASC is out-of-network with Commercial payers, the OON status does not necessarily make the situation riskier.

"The payer's only other opportunity is going to the hospital, which may still be more expensive than the out-of-network center," says Mr. Mello. "In that market, we wouldn't just conclude that the center needs a huge downward valuation adjustment because it's out-of-network. In other markets, where there is payer litigation, several out-of-network surgery centers and payers forcing providers in-network, we could reasonably conclude that there is more risk because we don't know when out-of-network will end and how much it will impact the center."

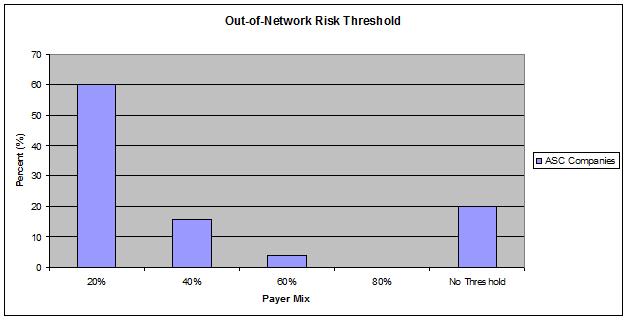

Most ASC companies adjust valuation models and pricing for out-of-network centers by converting revenue to in-network levels, and only 20 percent of respondents reported not having a threshold where out-of-network case volume would exceed their tolerance; 60 percent of respondents said 20 percent of total revenue being out-of-network exceeded that threshold.

"Uncertainty creates more risk," says Mr. Mello. "You don't want to pay a 7.0 or 8.0 times multiple for an out-of-network ASC and then have the earnings drop materially because they go in-network. There isn't a one-size fits all solution, but out-of-network is generally a riskier strategy. Some centers can survive that way depending on the market."

Management fees

ASC company management fees have ranged from 5 percent to 7 percent of ASC net revenue for the past several years. However, more centers are reporting fees closer to 5 percent now than in the past due to increased competition and center maturity.

"If you are competing against other managers/buyers and charge a higher percentage of net revenue in management fees, you may be disadvantaged," says Mr. Mello. "Additionally, ASC owners often want to lower the percentage over time. The hardest work is generally in the first couple of years — that's when the company spends the most resources to make sure the ASC performs well. Then the ASC companies' profit margins typically go up. But once the ASC runs smoothly they typically don't need as much support from the management company."

Many contracts have a threshold to lower the fee percentage. For example, the ASC may start off paying 6 percent of net revenue, but when the management fee exceeds a certain level, say $500,000 for example, they'll step down the percentage.

"ASCs generally have a compelling argument for decreasing management fees over time, and many companies will agree because there is a significant number of buyers competing for a limited pool of sellers," says Mr. Mello. Around 48 percent of survey respondents reported having arrangements where the management fee rate varies based on the level of revenue generated by the ASC.

More Articles on Surgery Centers:

How to Find Elusive Efficiencies in ASCs

5 Recent ASC Industry Leadership Moves & Accomplishments

Eliminate Staffing Overlaps: 7 Strategies to Run a Lean ASC

Higher multiples

The ASC industry has matured over the last decade, and changes in reimbursement, consolidation, and an aging and dwindling physician investor pool would suggest new buyers would pay lower multiples than in the past; however, the opposite occurred last year. Seventy percent of the survey respondents reported prevailing valuation multiples of 6.0 to 7.9 times EBITDA when purchasing a controlling interest in a single-specialty ASC. For multispecialty ASCs, 58 percent reported prevailing valuation multiples of 7.0 to +8.0 times EBITDA.

When compared with the previous survey — which 57 percent of respondents reported 6.0 to 7.9 times EBITDA for controlling interests in single-specialty ASCs, and 50 percent reported multiples of 7.0 to +8.0 times EBITDA for controlling interests in multispecialty ASCs — the price is going up.

"We have new surgery center companies sprouting up and others going or planning to go public, and people in industry think in the next four to five years there are still good opportunities to make money with ASCs," says Todd Mello, ASA, CVA, MBA, Partner and Co-Founder of HealthCare Appraisers. "The increased competition is driving prices up, and publicly traded surgery center management companies are transacting at 11 times EBITDA as seen in the Surgical Care Affiliates IPO late last year. Considering that one can purchase a multispecialty center at a multiple of 7 to 8 times EBITDA, this is still a good deal for the acquirer."

Becoming a publicly traded company opens up a new source of capital to fuel further growth for ASC companies; whereas, some private companies are more limited in their transactions and tend to manage their limited capital more judiciously.

"They don't want to spend it all on one deal," says Mr. Mello. "If you are an individual — or group of people — that has assembled seven to 10 centers, you become a very attractive target to buyers. Industry participants oftentimes can purchase a handful of marginal centers, make them profitable through additional syndication and business acumen, and then sell them to someone else."

Single-specialty vs. multispecialty centers

Typically, multispecialty centers attract higher multiples than single-specialty centers; it boils down to a diversification issue. If reimbursement for one specialty goes down, the impact could be devastating for single-specialty centers, while multispecialty centers could weather the transition more easily.

The valuation multiples for in-network single and multispecialty ASCs in the last 12 months were reported as:

Out-of-network impact

Typically, out-of-network centers are valued using lower multiples than in-network centers, but this is not universally true and oftentimes is geography specific. For example, in a market with one hospital and one ASC, where the ASC is out-of-network with Commercial payers, the OON status does not necessarily make the situation riskier.

"The payer's only other opportunity is going to the hospital, which may still be more expensive than the out-of-network center," says Mr. Mello. "In that market, we wouldn't just conclude that the center needs a huge downward valuation adjustment because it's out-of-network. In other markets, where there is payer litigation, several out-of-network surgery centers and payers forcing providers in-network, we could reasonably conclude that there is more risk because we don't know when out-of-network will end and how much it will impact the center."

Most ASC companies adjust valuation models and pricing for out-of-network centers by converting revenue to in-network levels, and only 20 percent of respondents reported not having a threshold where out-of-network case volume would exceed their tolerance; 60 percent of respondents said 20 percent of total revenue being out-of-network exceeded that threshold.

"Uncertainty creates more risk," says Mr. Mello. "You don't want to pay a 7.0 or 8.0 times multiple for an out-of-network ASC and then have the earnings drop materially because they go in-network. There isn't a one-size fits all solution, but out-of-network is generally a riskier strategy. Some centers can survive that way depending on the market."

Management fees

ASC company management fees have ranged from 5 percent to 7 percent of ASC net revenue for the past several years. However, more centers are reporting fees closer to 5 percent now than in the past due to increased competition and center maturity.

"If you are competing against other managers/buyers and charge a higher percentage of net revenue in management fees, you may be disadvantaged," says Mr. Mello. "Additionally, ASC owners often want to lower the percentage over time. The hardest work is generally in the first couple of years — that's when the company spends the most resources to make sure the ASC performs well. Then the ASC companies' profit margins typically go up. But once the ASC runs smoothly they typically don't need as much support from the management company."

Many contracts have a threshold to lower the fee percentage. For example, the ASC may start off paying 6 percent of net revenue, but when the management fee exceeds a certain level, say $500,000 for example, they'll step down the percentage.

"ASCs generally have a compelling argument for decreasing management fees over time, and many companies will agree because there is a significant number of buyers competing for a limited pool of sellers," says Mr. Mello. Around 48 percent of survey respondents reported having arrangements where the management fee rate varies based on the level of revenue generated by the ASC.

More Articles on Surgery Centers:

How to Find Elusive Efficiencies in ASCs

5 Recent ASC Industry Leadership Moves & Accomplishments

Eliminate Staffing Overlaps: 7 Strategies to Run a Lean ASC