Hospitals Need a Plan for Ambulatory Surgery

Hospitals are in an increasingly precarious situation. The drumbeat of changing healthcare policy, along with patients’ desire to be in a COVID-19-free environment and to limit their time in healthcare facilities, is generating even more pressure on hospital leaders to consider aligning and partnering with ambulatory surgery centers (ASCs).

Surgery generates a tremendous amount of revenue but is also one of the most expensive services provided by hospitals. Directing surgery out of hospital settings to ASCs presents significant cost-saving opportunities for CMS and commercial payers while posing a direct threat to hospitals’ bottom line. Hospitals and health systems without a cogent plan related to outpatient surgery may soon be faced with empty ORs, departing surgeons, and staffing reductions.

However, rewarding providers for delivering cost-effective care at lower-cost sites of service can create opportunities for hospitals that are proactive to the demands of the current environment. Hospitals that understand their exposure to surgical migration can develop a plan to offset and/or minimize the risk and position themselves for long-term success.

Payers Have Changed the Game

CMS, in its never-ending quest to reduce the overall cost of care to its beneficiaries, has approved several high-volume, high-cost procedures to be performed in the ASC:

• Hospitals currently perform more than 500,000 total knee arthroplasties (TKAs) annually on Medicare beneficiaries. At the start of 2020, CMS approved TKAs to be performed in ASCs. As a result of this change, hospitals stand to lose between $600 million and $1.9 billion, while CMS has the potential to save $150 million to $600 million annually should 10% to 30% of TKAs migrate to ASCs.

• In 2019 and 2020, CMS has approved numerous cardiology-specific procedures to be performed in ASCs. If 10% to 30% of the 550,000-plus annual cardiology procedures migrate to ASCs, CMS would experience an annual savings of between $125 million and $380 million, while hospitals would see a revenue reduction of $370 million to $1.1 billion.

With a potential combined savings of $275 million to almost $1.0 billion annually from relatively few procedures within two clinical service lines, CMS continues to examine opportunities to enable migration to lower-cost sites of service. This is clearly indicated by the approval of total hip arthroplasty for HOPDs in 2020, and trends suggest CMS will approve total hip by 2021 or 2022 for ASCs.

Furthermore, private payers are redesigning their benefit options to focus care in lower-cost settings. Effective November 2019, UnitedHealthcare, one of the largest commercial payers in the country, implemented a series of policy changes to direct patients to lower-cost surgical sites of service and limit and/or remove access to benefit coverage in the hospital setting. The new policy includes 65 musculoskeletal procedures that require site-of-service reviews and prior authorization for services to be provided in a hospital outpatient setting (with the exception of Alaska, Kentucky, Massachusetts, and Texas).1 Providers and patients are given a list of available participating ASCs with services offered. These types of payment policies and benefit designs significantly affect access to hospitals and reduce the cost of surgical service, regardless of the employment status of a surgeon or the referral to a specified site of service.

Lessons Learned: Case Studies in Surgery Migration

ECG has deployed our surgical migration methodology2 at numerous client organizations to quantify their exposure to surgical volume migration. The case studies below offer high-level reviews of several organizations’ experiences with surgery migration.

Conducting TKA Planning for a Life Sciences Organization

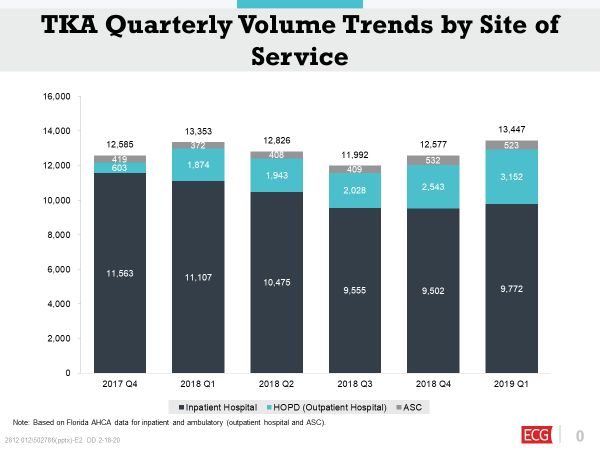

As part of our work supporting the development of a marketing plan for a national health and life sciences organization, as shown in figure 3, ECG examined the migration of TKA volume by site of service in Florida from the fourth quarter of 2017 to the first quarter of 2019. In January 2018, TKAs were removed from the inpatient-only list, resulting in 423%, or 2,549, additional cases shifting to the HOPD setting in the first quarter of 2019 as compared to the fourth quarter of 2017. During this same period, inpatient cases decreased by 15%, representing a decline of almost 1,800 cases. We expect similar trends with TKAs in the ASC setting, as Medicare approved them in 2020, potentially with greater acceleration due to COVID-19.

Figure 3: TKA Quarterly Volume Trends by Site of Service

Since CMS approved TKAs in HOPDs in 2018 and in ASCs in 2020, we expect this migration trend to continue to experience aggressive growth over the next decade. As a result of this work, ECG’s client established specific goals and strategies to expand its coverage within the Florida market.

Helping a Community Hospital Develop an ASC Strategy

A freestanding community hospital stood to lose upwards of $40 million if a large multispecialty group in the area opened a competing ASC. ECG conducted a surgical migration assessment and completed an HOPD operations review, which quantified the potential risk of lost outpatient surgery volume if a group of more than 120 physicians developed its own ASC.

» By developing multiple models, we helped our client evaluate different scenarios and measure the financial risk of various joint venture (JV) structures and equity models.

» We concluded that the potential revenue losses ranged from $2 million if the client successfully developed an ASC to $40 million if the physician group developed a freestanding ASC without the client’s involvement.

We worked with our client to develop an ASC strategy to assess alternative structures and partnership options to reduce the risk of a potential loss of millions of dollars.

Facilitating JV Planning with a Health System and Physician Group

A health system was forced to examine its relationship with a group of physicians who decided to develop an ASC with or without the system as a partner. ECG conducted an ASC-eligible case volume analysis to determine the projected cases that were at risk for migration from the hospital to the ASC, with a specific emphasis on TKAs.

» The health system had approximately 7,100 orthopedic cases performed in the hospital.

» Prior to the approval by Medicare of TKAs in ASCs, 56% of the total case volume, or approximately 4,000 cases, were identified as ASC-eligible for migration to the orthopedic ASC; of these, 287 cases were TKAs.

» With the approval of Medicare TKAs for ASCs effective January 1, 2020, the projected ASC-eligible volume for TKAs in year one increased by 68%, to 482 cases, representing a potential loss of revenue in excess of $10.5 million.

» The migration of cases would leave the hospital with the capacity of six ORs and require it to backfill with new cases; if there were no cases available, the hospital would be faced with OR closures and staffing reductions.

Facing inevitable losses, the system established a physician-hospital JV with the surgeons and developed a state-of-the-art de novo ASC so they could retain some of the value of the surgeries that were targeted for migration. ECG has since worked with the JV on a managed care strategy to optimize the orthopedic surgery reimbursement in the ASC, which reduced the losses to the hospital as a result of migration.

Optimizing Opportunity with Surgery Migration

These case studies highlight how critical it is to understand the risk of migration and the need for hospitals to develop robust ASC growth plans. In addition, with the prevalence of COVID-19, the implications on the demand for migration have accelerated and are expected to continue. A comprehensive strategy can help hospitals mitigate losses that are inevitable and take advantage of the opportunities related to surgery migration.

» Patient Experience: ASCs offer patients a highly personalized and efficient environment, with lower nurse-to-patient ratios and a reduced cost of care—all of which results in increased patient satisfaction. Furthermore, the perception of ASCs as COVID-19-free zones has increased interest and the demand for ambulatory surgical care.

» Physician Alignment and Experience: Robust ASC JV partnerships and comanagement agreements allow physicians and hospitals to focus their unique skill sets on enhancing patient care, improving outcomes, and reducing the cost of care. Engaged physicians will have a vested interest in the JV’s success; incentives and rewards can be based on reducing total cost of care while achieving outcomes with measurable goals. Additionally, the design of a modern ASC environment enables physicians to gain efficiencies in surgery scheduling, OR turnover time, and on-time starts. Being able to schedule more patients in a day and reduce delays also increases overall satisfaction.

» Employers Holding Health Plans Accountable: Many employer groups are self-insured, and they contract with large payers to gain access to their contracts with providers and process their claims. Employers are tracking their healthcare spend and holding payers accountable for cost containment. As a result, more and more health plan benefits are being designed to reward employees for seeing providers who direct care to lower-cost sites of service, such as ASCs, and for receiving treatment at lower-cost sites of service, by reducing or removing out-of-pocket copays, coinsurance, and/or deductibles. Hospitals that offer services at competitive prices are more apt to reap the benefit of continued participation in these networks and garner favorable relations with the local employer community.

» Payment Innovation: Surgery migration presents hospitals and health systems with an opportunity to optimize alternative payment models. For example, BPC-I and CJR payment models all require a hospital or health system to provide care to patients for a specific number of days at a set rate. This sets up a rare win-win situation for hospitals and ASCs: the right contractual relationship can help an ASC to increase its volume and reimbursement while giving a hospital a lower-cost alternative that enables it to optimize its bundled payment and/or gainsharing contract. This also allows for the development of incentives to reward surgeons who have measurable outcomes and quality indicators that have been met in the ASC.

By developing and implementing a cogent plan for addressing surgery migration, institutions can proactively partner with their physician community and take advantage of emerging opportunities in this transformative time. ASCs present an opportunity and solution for reducing the total cost of care and enable hospitals and health systems to develop partnerships with physicians so all parties can bring their sustainable competitive advantages to the venture while working collaboratively for long-term success.

Consider the risks of migration, and determine whether an ASC presents an opportunity for your organization.